The Set Up

Recently I had a interesting discussion with a VP of Sales about who owns the Sales Pipeline, marketing or sales. Truth be told both functions own the pipeline at different times in the Commercialization process. Same holds true for the sales process.

My view is that the pipeline and process can’t be seperated. The process dictates the drop out points along the pipeline.

The Problem

If you don’t understand the sales process and the sales pipeline you can’t predict the need for demand generation (leads). If the pipeline progression is not under control or is not predictable you can’t calculate a success rate. Without understanding the process and efficiency you can’t determine the cost of account acquision.

What is a “Sales Process”?

The sales process is simply the step-by-step progression of activity that the sales professional goes through to successfully close the sale. Is it the same every time? It depends on the type of product and the type of sales approach required. It is not at all unusual that within the same company there will be nuance that change the process steps or important of the steps.

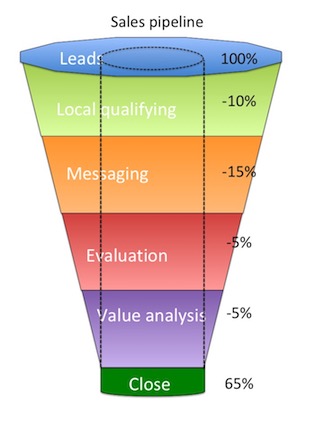

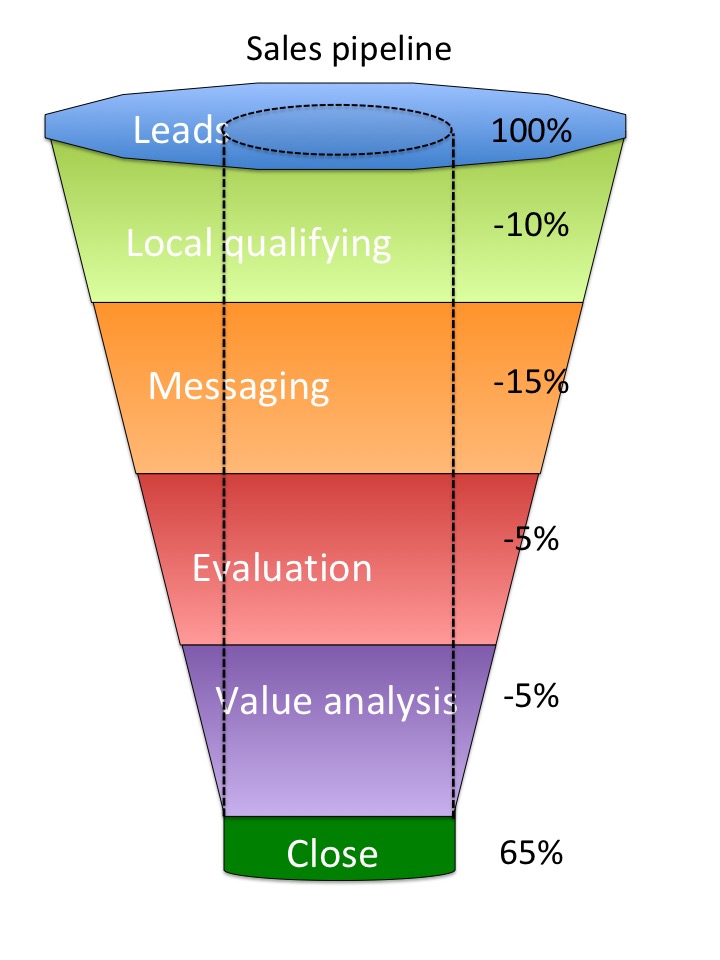

Simplified sales process

For this lesson a very simple sales process will be used.

- Lead generation

- Local qualifying

- Messaging

- Evaluation

- Value analysis

- Close

Example: You may sell a product that needs very little hands on experience by the physician to understand the value. In the same portfolio you may have a new product that requires hands on expeirence, touch and fell to understand the value. The Evaluation step will be more critical with the second product.

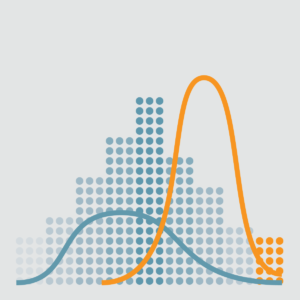

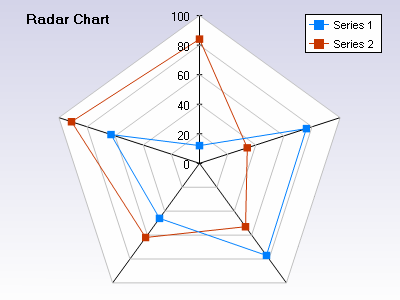

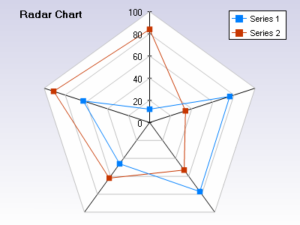

The sales pipeline is the aggregate production by step of the sales process. The sales pipeline as shown here is a great visualization of the success of each process step. As shown the sales process has a 65% success rate. From the progression we can see that most of the loss is in Messaging. A deeper dive on how the messaging is not connecting with the physician is warranted.

So who owns the process and the pipeline?

It is always best to work as a team. Bring in some of the best sales professionals during the development of the process.

during the development of the process.

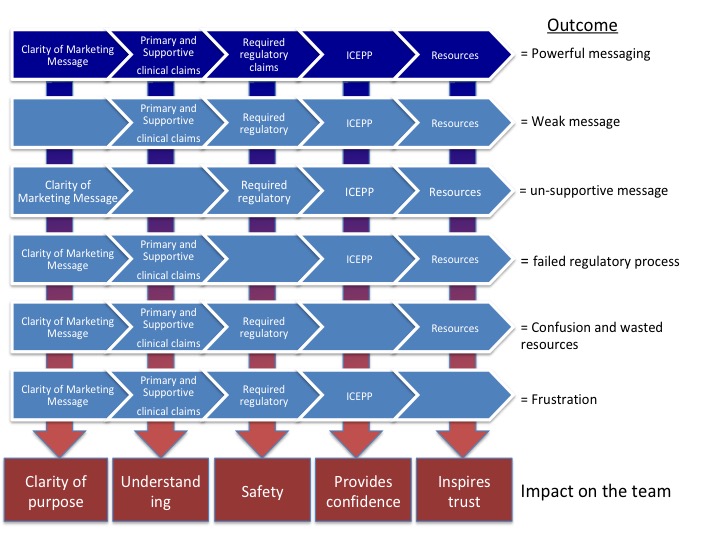

The way I see it pre-launch, the marketer acts as the architect of the process and conducts a validation of the pipeline. The marketing’s job is to make the pipeline as efficient as possible at launch. Where the leads come from and at what rate is the marketer’s job. Determining the qualifying criteria is the marketer’s job. Crafting the messaging is the marketer’s job. How the evaluation is conducted is the marketer’s job. Having a strong value proposition is the marketer’s job.

Post-launch it is the Sales professional job to nuance and perfect the steps in the pipeline. Use their local knowledge of the account to their advantage. Produce a 65% success rate or better. Communicate improvements into marketing so they can validate the process improvement and communicate outward the new best practice.

The advantages of understanding the nature of the sales process and the drop out points of the pipeline are:

Advantages

- Predictable demand forecasting

- Metric for sales force performance

- Diagnostic tool for macro and micro improvements

- Produces a common language

- Provides a tool for sales management to monitor the sales force path to competency

Other key aspects of the pipeline

Other key aspects of the pipeline are the velocity and progression through the pipeline. The sales cycle may take 15 days to 2 years to complete. Momentum is important to carrying the “good news” throughout the process. If you stall out in any step it will take extra effort to kick-start the process forward. Cost of acquisition goes up at an escalating rate.

- Velocity

- Momentum

- Continual progress

Lessons

- Partner with sales professionals to develop the sales process

- Validate the drop out points during a controlled or limited launch

- Use the pipeline as a quality tool not as a fault hammer

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com. Contact The Experia Group for a free 30-minute consultation to determine if 30-years of experience can contribute to your success.

© 2018, The Experia Group, LLC