Prelude

In recent weeks, I have had discussions with three potential clients about their shot-gun approach to launching their new technology platforms. My advice was the same for each of them, FOCUS is power.

Pick the right channel, or product, or therapy to go after, and then apply all your assets to entering that market segment. The return question, ‘how do I know which is the ‘right product, channel, or segment?’

Set-up

A fourth potential client had it all figured out and was just looking for confirmation and a bit of help in doing it. He wanted to start with segmenting the market for his technology platform. This top-down-market approach is not the only approach, but it is the one that will more often than not, put you on the pathway to successfully developing the first right product and developing a strong go-to-market strategy.

Understanding the market, or sector, or sub-market that you are in is never a luxury, it is essential.

If you are not sure which way to go or which product to commercialize then immerse yourself into the market.

This is particularly of value when you have developed a technology platform that eventually could serve every segment of your target market. Before you invest in the first new product take the time to do a full market assessment.

How do I know which is the right first product?

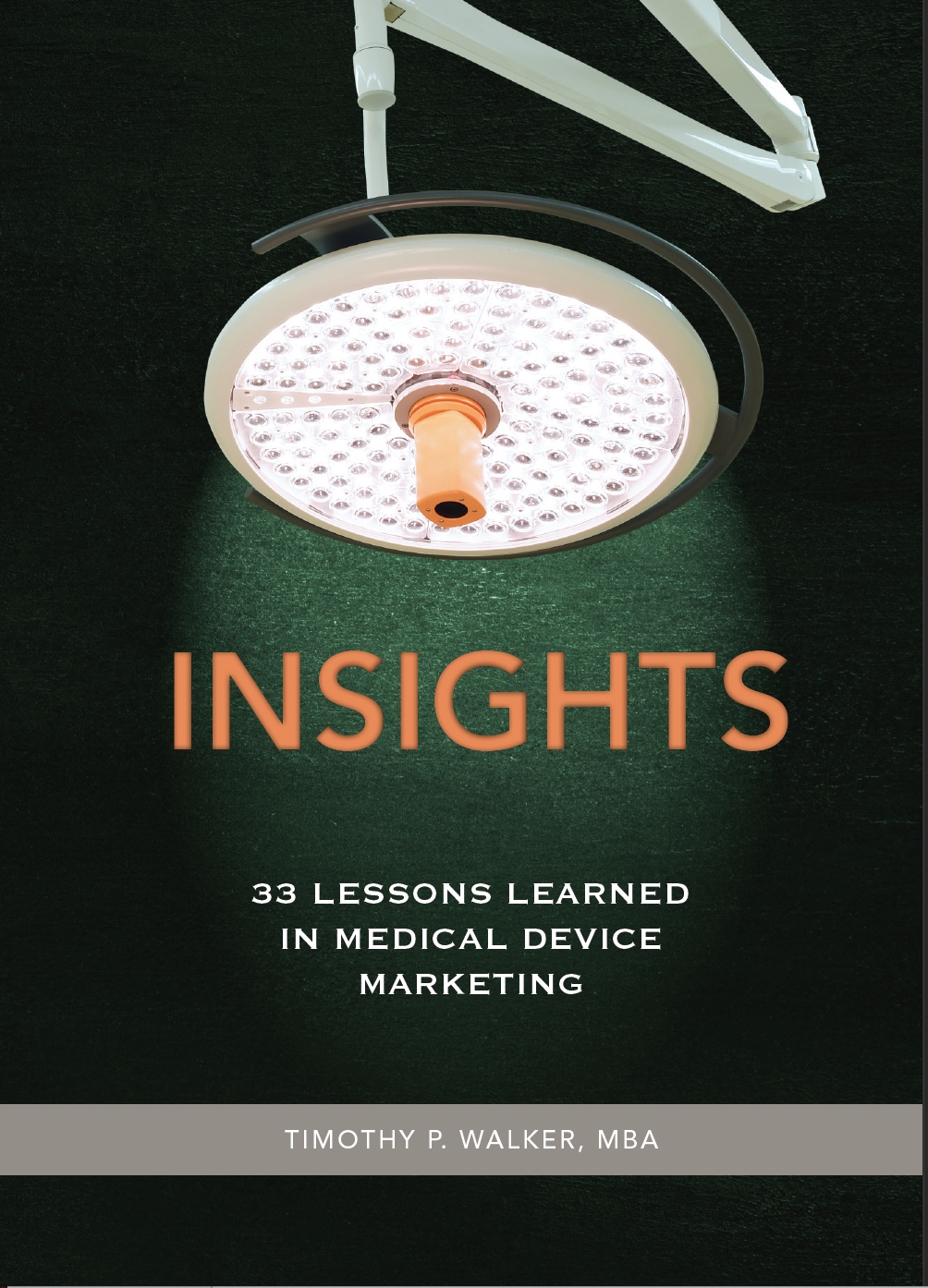

Follow this high-level process: (note: there are many sub-steps and significant effort implied within each step).

Step 1: Perform a high-level market scan

Step 2: Establish acceptance criteria for selecting the segment, this will be unique to your company.

Step 3: Map the relevant populations, map the disease(s), map the therapies, map the buying processes, map the projected patient journey, for each possible segment.

Step 4: Review the information from step 3. Retire segments that clearly do not have a chance of meeting the entry criteria.

Step 5: Treat each of the remaining segments as a singular opportunity. Conduct Opportunity Assessments based on the product you have identified for each segment.

Step 6: Compare and contrast the Opportunity Assessments (discussed in an early post or in Lesson 22 in Insight: 33 lessons learned in Medical Device Marketing available on Amazon).

Step 7: Select and commit.

If these steps sound like a ton of work, they are. Is there a way to cheat ahead and get things moving while you finish the work? Of course, you could deploy a Monte Carlo method, however, you still have to collect the information needed for the first three steps before you run a qualitative simulation.

Once you have these pieces in place, then you need to recruit 3-5 true experts in these types of assessments and or in the market segments they seem to have the ability to meet your criteria.

Give them the data and let them apply their intuition to fill in the gaps. During a day-long interactive process, you come to an understanding of all their points of view. If consensus is possible, even better. These types of processes are directionally accurate about 80% of the time.

With the finding of the group, get started on defining the product concept using appropriate VOC techniques.

But don’t stop the process. In parallel continue to define the alternate possibilities. If any of the assumptions that were used to reach the findings prove to be incorrect, adjust.

The narrower the focus, the deeper you can go into the customer’s true unmet need. The deeper into the unmet need, the higher the probability that you have a commercially viable product.

What if we don’t figure it out and just pick one and go for it?

That certainly is one way of doing it, it has worked for others. But more often than not, it results in costly re-directs, failed launches, a loss in investor confidence, and a host of lesser issues. Time and cash are the critical aspects of any project.

The narrower the focus, the deeper you can go into the customer’s true unmet need. The deeper into the unmet need, the higher the probability that you have a commercially viable product.

It is all about risk and capital.

Being intentional about the decision you make and the desired outcome you want, is a whole lot better than wandering about looking for something you haven’t even defined. A worthwhile read to get your mind around the process for sorting out the critical few, essentialism: The Disciplined Pursuit of Less, by Greg McKeown. While I don’t agree with everything that is advocated in this book; I do agree that focusing on the critical few is far better than trying to do everything and just hoping something works.

Lessons:

- Actively studying the market is not a waste of time nor money.

- Understanding the market is not an option, it is a must-do.

- Take careful aim before pulling the trigger, this way you won’t waste ammunition (cash and time).

“Experience is what you get, right after you need it most.”

Make it a great day!

Tim Walker

Tim Walker is the Principal Consultant for The Experia Group, a consulting firm specializing in providing experience and expertise during critical device commercialization phases to increase the probability of success.

One-on-One, or, team coaching is available.

www.theexperiagroup.com. Contact, The Experia® Group for a free 30-minute consultation to determine if 30+ years of experience can contribute to your success. [email protected]

Available on Amazon

© 2021, The Experia Group, LLC