Set up

I saw a half dozen posts this past week that announced New Medical Devices. So this INSIGHT goes out to those product managers that produced those notices.

Was there something inherently wrong in those announcements? No. Could they have been better? Yes. Given that they were merely announcements, they weren’t necessarily intended to convey the entire message. So please take this post as an opportunity to think deeper.

So how could they have been improved?

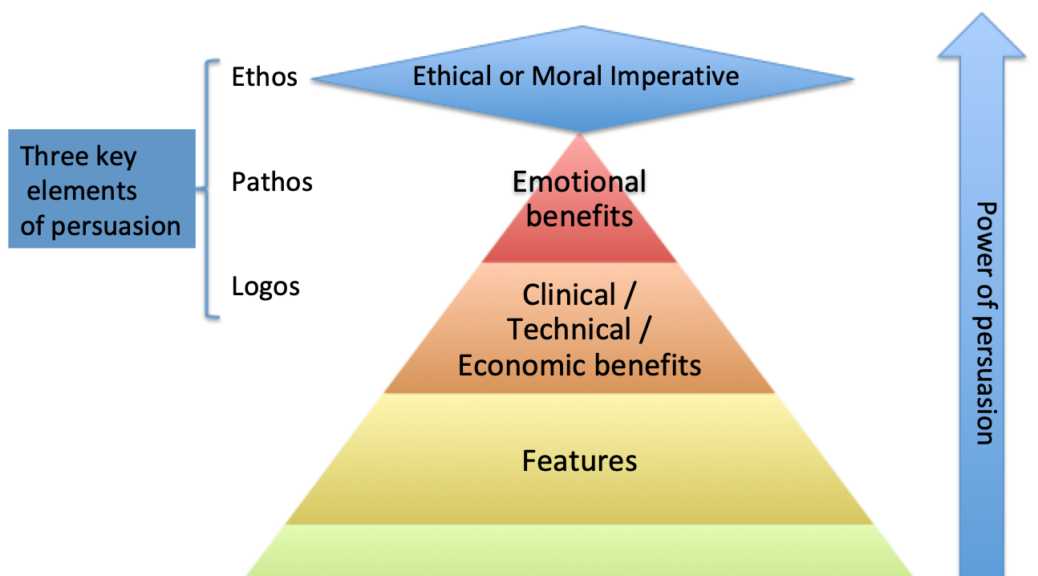

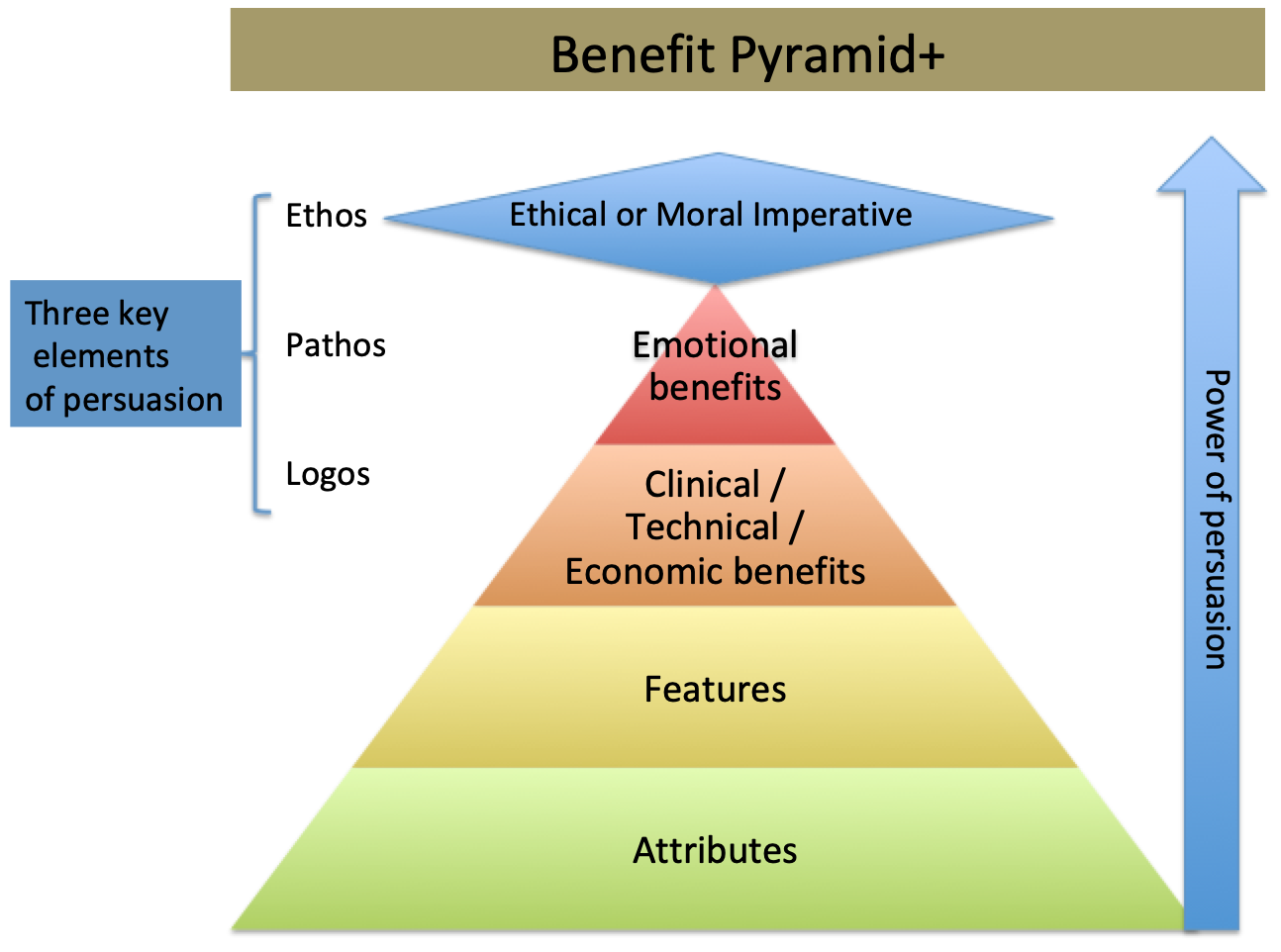

By applying the lessons of the Benefit Pyramid. Most of the content of the announcements referred to Attributes or Features of the devices. Seen in the image below, Attributes and Features have a low impact when persuading someone to act differently. I would offer that if a message that focuses on features is successful, it is because the clinician is projecting the benefit they might derive from those features. As a product manager, being intentional about messaging you will realize that counting on a very busy clinician to project a benefit is not as strong a position as you telling them how the device will be beneficial to them.

For most of us mortal marketers, we target benefits, for those among us who truly understand the psychographics of their targeted clinician customer we suggest or present an emotional benefit that they derive from using our devices.

In this post, I add one more element, hence the + sign. So this new benefit pyramid represents a change in the way I think about persuading clinicians to change their behaviors. It takes into account the ultimate persuader, a moral or social imperative. The closest I have ever gotten to explain the impact of a product as a moral imperative is when I market a safety device.

One only need look to the writings of the Greek physician Hippocrates to discover aspects of the medical ethos and why they might consider safety and having clinical data as a moral imperative.

Hippocratic Oath:

“I will follow that system of regimen which, according to my ability and judgment, I consider for the benefit of my patients, and abstain from whatever is deleterious and mischievous.”

Of the Epidemics:

“The physician must be able to tell the antecedents, know the present, and foretell the future — must mediate these things, and have two special objects in view with regard to disease, namely, to do good or to do no harm.”

Lesson(s)

- The higher up the Pyramid you can go the more power your persuasion will be

- Take the time to dig deep to discover the benefit your product will provide

- To tap the p persuasive power of the Benefit + Pyramid, you must authentically believe in what you are saying in your messaging

“Experience is what you get, right after you needed it most.”

Make it a great day!

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com. Contact The Experia® Group for a free 30-minute consultation to determine if 30-years of experience can contribute to your success. tim@theexperiagroup.com.

© 2019, The Experia Group, LLC

On Amazon.

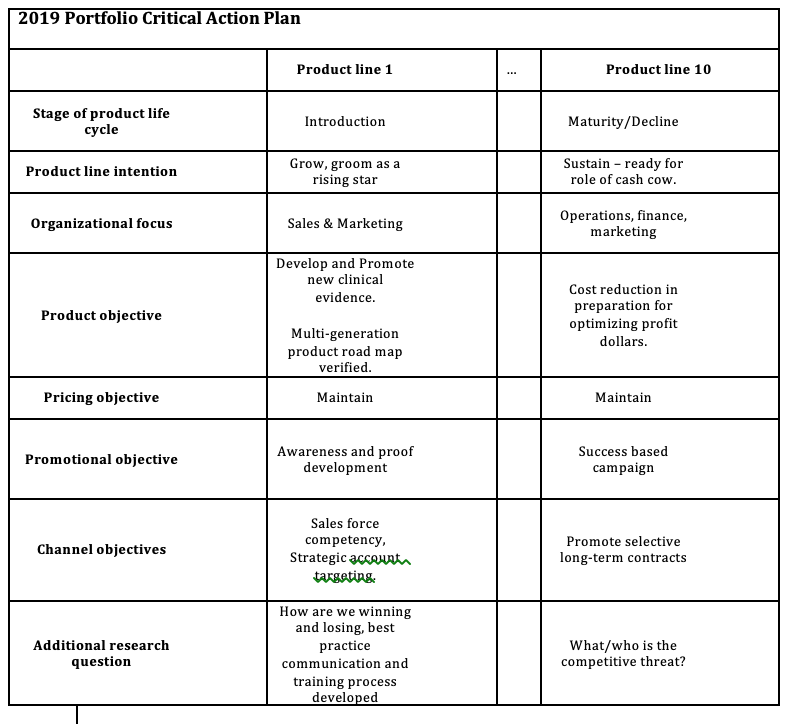

start with a loose objective. By this I mean it should be consistent with your current corporate positioning. I.e., if you are known for safety, then you should be looking for opportunities to provide a higher level of protection. If you are known for quality, then look for opportunities surrounding improving quality. If you are known as a company that brings therapeutic products then identify an underserved disease or patient type.

start with a loose objective. By this I mean it should be consistent with your current corporate positioning. I.e., if you are known for safety, then you should be looking for opportunities to provide a higher level of protection. If you are known for quality, then look for opportunities surrounding improving quality. If you are known as a company that brings therapeutic products then identify an underserved disease or patient type.