The Story

Once during a staff meeting, the marketing team was discussing the portfolio of products that were under development. Of the Product Managers gathered at that time, five of them were preparing to launch new products and two were post-opportunity recognition and pre-requirements planning.

The discussion worked its way around to the realization that only one of the seven managers had formally written the “positioning statement” for their respective products. We bantered about the question of when should you write the positioning statement for the new product. There were positions voiced around the table that ranged from, after verification testing, to after limited market evaluations.

Coming out of that meeting all seven managers were given the assignment of writing position statements for their new products. Not surprisingly, over the next three days I was asked, “What makes a good positioning statement?” I was also asked, “Why one needed to be written them at all?”

Why write product-positioning statements?

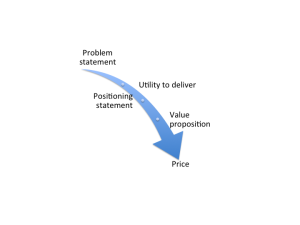

I have always believed, that the most enjoyable part of being a Product Manager was the early phases of defining a potential new product. No boundaries, no conditions, a clean canvas upon which you painted a dreamscape for your product. This is when you reach for the stars. This creative writing exercise, for me, often resulted in two-to-five pages of text and included a description of the clinical environment, the nature of the clinician character, the problem statement, the perfect utility that the product could deliver, a forecast, a theme and never, never was restricted by the technology that was known to my company at that time. Very few of these stories have ever been read or even been seen by my colleagues. I used to think that it was a silly indulgence. What I now believe is that it is a critical aspect, which differentiates good new product definitions, from great ones.

What are marketers, if not the inventor of the story and the keepers of the vision?

Why write them?

Simply, we need to write the Product Positioning Statements to be able to concisely describe a vision to others, so that they can join us in making that story come to life. It is our elevator pitch to the organization and parallels the sales persons elevator pitch to the clinician customer. It is the executive summary of the multi-page story.

One real benefit to me has been that writing and telling the story imprints a vision of success in my mind and spirit. These visions of success often infected those around me, and instill a sense of confidence within them.

When should we write them?

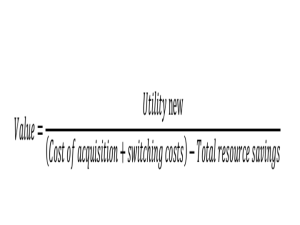

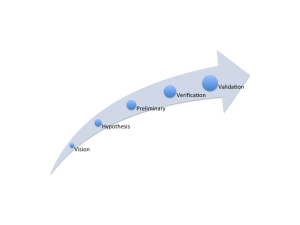

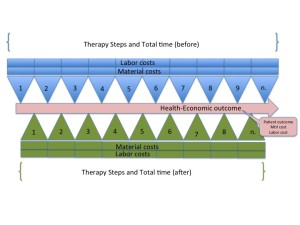

So I think it is obvious that the value proposition should be written before the requirements planning process. The expense associated with research and other VOC activities is significant. You owe the organization a complete vision before you incur those expenses. If you can’t generate some excitement with your vision then you shouldn’t move forward, yet. Requirements planning reduces the grand story to something particle, that is tied to internal limits of resource and capability. The initial positioning statement never survives to the launch. Keep it current and revise it as needed. Always ask the question, “Is it still worth going after?”

What makes a good one?*

For the first ten-years of my marketing career I didn’t know what made a good positioning statement. I wrote good ones instinctively and mine were never consistent from product to product. At some point I took a class and some really smart instructors from Stanford laid out a template. I use this template as a starting point for every positioning statement I have written since then.

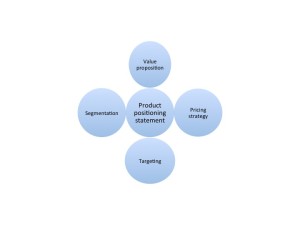

There are seven distinct elements required for a complete positioning statement:

- Customer identification

- Description of those customers problem

- The name of the product (preliminary)

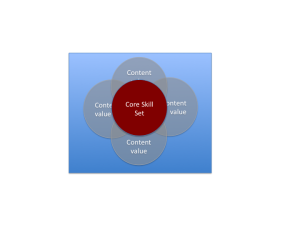

- A basic description of the product utility

- A description of the components that offer the most relevant value (functional or emotional benefits)

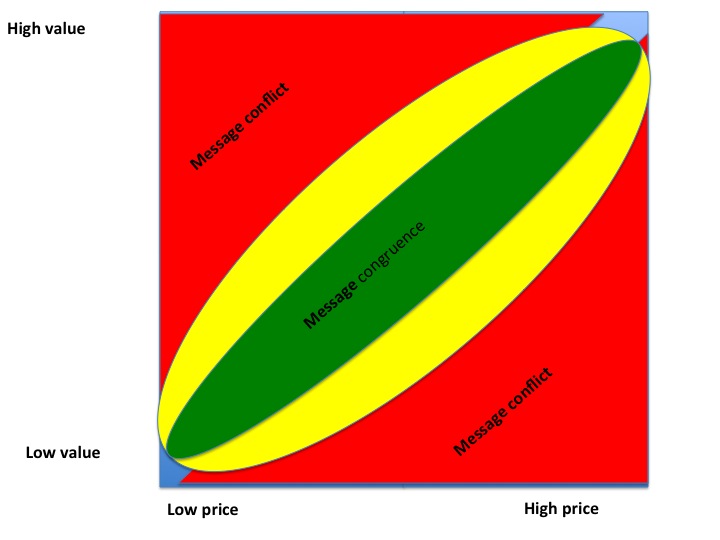

- How it is different from competition

- Reasons to believe

Format of a positioning statement

The statement is typically written as a single paragraph, I use two. However, your style can vary as long as you include the seven elements, can recite it in 15 seconds, and it test as a strong statement. The paragraph typically follows the following structure:

For… . Who… . The… . Is a… . That… . Unlike… . It… .

Example (completely fictitious):

For the cardiovascular surgeon, who believes in the clinical benefits of beating heat surgery. The Squid is a combination rib spreader, holder, and electrical isolation device. The (that) Squid offers maximum visibility and access to the heart, hands-free stabilization and counter traction, with the added ability to electrically isolate small areas of the muscle, all to provide a still and placid surface on which to sew. Unlike many devices on the market today that perform only one of these functions and do not offer an integrated solution to the problem of high quality stitching on a beating heart, such as the: [list competition here].

The Squid (it) is offered by the leading manufacture of surgeon-focused equipment in the World today. It was designed for the unique requirements of the CV surgeon as directed by Dr. Spock, head of surgery at the Never-Never Land Heart Institute.

How strong a statement is it?

Test your statement against the following four questions:

- Is it compelling?

- Is it distinct?

- Is it achievable?

- Is it sustainable?

Have a group or independent marketers score the strength of your statement against the above four questions. Have them provide the reasons for their scores and then try to incorporate their feedback until an independent group scores you strong on all four counts. Strong, average, poor makes a good scale.

*I have committed this template to memory and I don’t have any of the original course material. There is no way I can attribute this to its source. Suffice it to say that I did not create it and take no credit for it. I have used it more than 20 times and every time the exercise has proven invaluable to me.

“Experience is what you get, right after you need it most.”

Make it a great day!

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com.