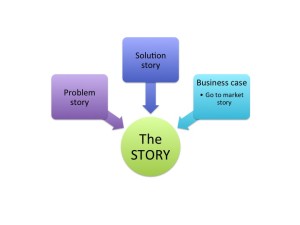

The Story

A great product manager friend of mine had spent three (3) years driving a product to market. At long last he was on the precipice of launc h and his wife read the value proposition and said to him, “I don’t buy it.” Normally, this off handed comment would not have affected him, however in the case his wife was also a prospective customer. He started to doubt the product concept and reached out to me as a second set of eyes.

h and his wife read the value proposition and said to him, “I don’t buy it.” Normally, this off handed comment would not have affected him, however in the case his wife was also a prospective customer. He started to doubt the product concept and reached out to me as a second set of eyes.

This product should have taken 18 months to get ready for launch. However, several personnel issues, technical challenges and of course a poor regulatory strategy had made the commercialization process a huge battle. He had invested so much emotional energy in just getting is ready for launch that he had lost the vision.

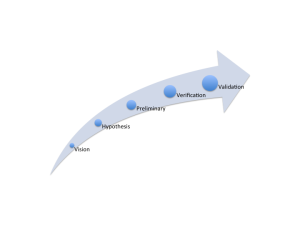

So here is his learning, as you roll the Value Proposition through the R&D phases toward commercialization it is easy to get lost in the day-to-day effort it takes. But from time to time you need to stop and separate yourself from the emotional connection you have to your device and ask is this product still relevant? Is it still believable? (Or have a trusted colleague do it for you). He had gotten so busy helping the team be successful that he had compromised his commitment to constantly check in with the customer along the way to see if he was still on course.

The Vision is Job 1

Once you propose a product concept and get the ball rolling within your company you need to, as best you can, free yourself of the inevitable details of product management and stay in a pure marketing mindset. You are the only one who can be the keeper of the Vision. Your role is to sell the vision, over and over and over again. Keep the team on course.

Once you propose a product concept and get the ball rolling within your company you need to, as best you can, free yourself of the inevitable details of product management and stay in a pure marketing mindset. You are the only one who can be the keeper of the Vision. Your role is to sell the vision, over and over and over again. Keep the team on course.

Don’t let them react to one customer’s voice. Make sure that every new voice is taken into account and melded into the overall strategy. There will be constant pulls to get you off track. Gently but firmly, keep the crew pulling toward the same destination.

Don’t let them react to one customer’s voice. Make sure that every new voice is taken into account and melded into the overall strategy. There will be constant pulls to get you off track. Gently but firmly, keep the crew pulling toward the same destination.

Utilize your customers to help. Periodic check-ins to see how you are progressing toward that destination is critical.

What if we do get off track?

The worst thing is to launch a product and have it flop. Launches cost $100,000 to millions of dollars. The opportunity cost for the sales organization is huge. Not least is the hit your departments reputation will take for future launches. If you keep checking the Vision’s viability and if the product is living up to that Vision you should be ok. But if something is off, raise the flag! If you raise the flag early enough, course correction might be at a team level only. Raise the flag too late in the process and then it will be out of the teams’ hands. Either way you need to raise the flag. In an intelligent organization the raising of a flag is not the career limiting action you might fear. Not raising the flag and flopping might well be career ending.

The worst thing is to launch a product and have it flop. Launches cost $100,000 to millions of dollars. The opportunity cost for the sales organization is huge. Not least is the hit your departments reputation will take for future launches. If you keep checking the Vision’s viability and if the product is living up to that Vision you should be ok. But if something is off, raise the flag! If you raise the flag early enough, course correction might be at a team level only. Raise the flag too late in the process and then it will be out of the teams’ hands. Either way you need to raise the flag. In an intelligent organization the raising of a flag is not the career limiting action you might fear. Not raising the flag and flopping might well be career ending.

What type of things can get you off course?

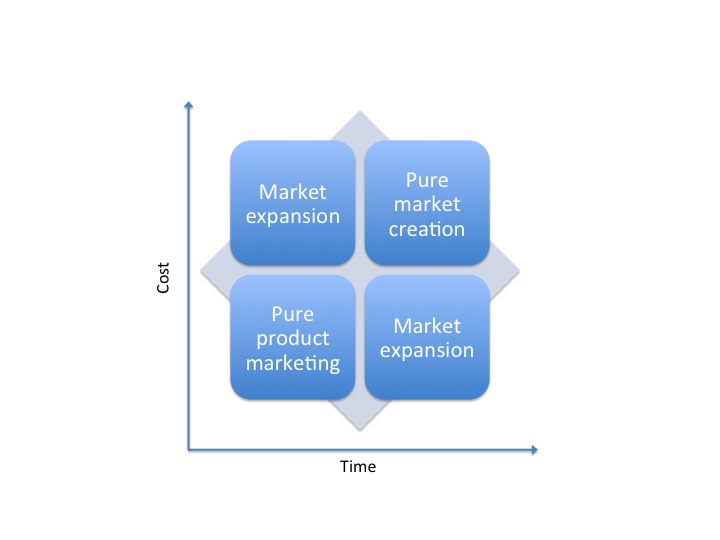

Unfortunately a whole lot of things can blow you off course. Both internal and external aspect of the opportunity can change. Some of the things to be aware of are;

- Technical design decisions that seem benign to engineers can really sneak up on you and do damage to the value proposition.

- Competition can beat you to launch with a similar product

- A new technique or substitute technology can blow you out of the water

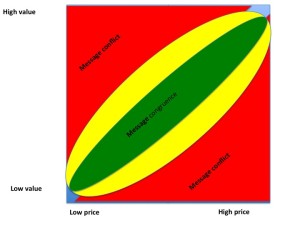

- The cost of the product may preclude you from being profitable, the temptation will be to raise your target price until you are profitable, and however, you may price yourself right out of the market.

- The incidence and prevalence of the problem you were solving may change.

- There may have been an untested assumption that raised it head later in the process and proved more impactful than originally thought.

and many, many, more.

This is why you need to continue to validate your original beliefs. Keep the environmental scan sweeping the skies around your product Vision. Take a lesson for the military and don’t shut down the radar after the first sweep. Things change with time and events.

How did the story end?

My friend was ok. His wife’s hospital was not in his customer segment. He stopped the full launch and did a soft launch into only targeted centers and everything went well. Not perfect. Some of the decisions that were made at the team level with respect to design were changed to optimize acceptance within the target. The changes did not trigger a new regulatory filing and delayed the launch by 3 months.

In the defined segment the product is now number one in unit share! The segment did turn out to be smaller than expected.

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

p.s. please feel fee to comment on this or any of my posts.

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com.

© 2016, The Experia Group, LLC