The Story: I attended a recent Med Device investor conference and was approached by a colleague who had been following my blog for a year or so. I’ve known this gentleman for over 20-years, but had not spoken with him in quite a while. He asked when I was going to post something about doing Opportunity Assessments.

It is funny how people pigeonhole you into different skill sets. He remembered a Market Assessment I had done in the 90’s that apparently impressed him. I have done so many assessments, both Product and Market that I had to look it up. I was humbled by the fact he remembered it.

A second gentleman that was at this same conference remembered me for the way I developed a Product Portfolio, he asked when I was going to blog about that topic. Again I was humbled. This guy is as sharp as they come.

Both topics are huge in scope. This post will set up some thoughts and definitions; I will follow-up with a more detail set of posts over the next month or so.

Opportunity Assessment defined: An opportunity assessment is the systematic, fact based, analysis of the market and/or product variables and assumptions that are used to determine the future financial viability of a given “Opportunity”.

Portfolio Plan defined: The Portfolio Plan is the resultant of a systematic decision-making process that combines a series of investment options (opportunities) into a strategic investment across time. When the opportunities are combined they will optimize that investment against a strategic objective set forth by senior management, hopefully that came out of a formal strategic planning process.

Connecting Opportunity Assessments and Portfolio Planning: You can create an Opportunity Assessment completely independently of portfolio considerations. But to do a serious Portfolio Plan you can’t do it without a series of valid Opportunity Assessments. To facilitate a defendable Portfolio Plan you have to make sure that the methodology used to develop the Opportunity Assessments is consistent and not based on opinion.

Side note 1: Even if your organization uses M&A activity to build the Portfolio you still need that Opportunity Assessment. You might just call it Due Diligence. Take care to ensure that all departments use the same Opportunity assessment rules and validation requirements.

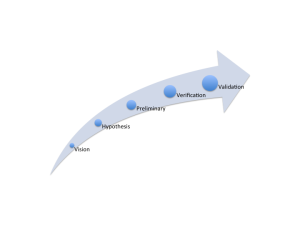

Side note 2: Depending on how your organization is structured, you will more than likely need to build the assessment in tiers of certainty. Some of the work takes resources and if you don’t have the resources you need then you will need to convince someone that the opportunity is worth looking into. Think about the following flow:

- Vision

- Hypothesis

- Preliminary

- Verification

- Validation

What does a good Opportunity Assessment look like? It all starts with defining a problem in a specific therapeutic area or market. Opportunity identification is a whole different topic. For this post I will assume that the problem has been identified.

So the key questions that must be answered are:

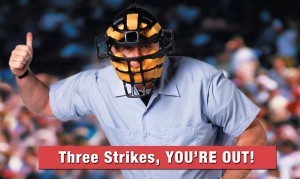

- Is the opportunity real?

- Is it worth going after?

- Can your company win, if they go after it?

A NO to any of these basic three questions suggests that it is not viable, for you. Of course everything has many shades of gray and all assessments are nuanced by political, economic and time frame realities. So I will write from a simplified dogmatic position. Take it for what it is worth to you.

Is the opportunity real? There are two parts to this question. Is the problem real? Is the solution real? To answer these questions you must have a clear understanding of the un-met need. You must also have a reasonable belief that full utility can be delivered via the final product design at a cost that is affordable.

Side note 3: A mistake that often occurs is that someone sees a problem and assumes that everyone must see, have, or suffer from the problem. This is seldom the case. A measured assessment of the size of the opportunity is step one.

Side note 4: In almost all cases the problems are already being solved or mitigated today, somehow to some extent. Don’t discount the value of understanding how this happens. In a latent need these substitution solutions maybe your largest competitive hurdle.

Is it worth it? This a unique question that each organization will answer differently. Depending on your grand objectives that have come down from the Strategic Plan there maybe hurdle rates that must be met even to be considered as a viable opportunity to be considered.

In general this is a financial/strategic question that requires a number of models and market/segment/solution assumptions to be made. The more informed these assumptions are, the better the decisions will be.

Typical you will need:

- A disease model

- A market model

- A set of explicit solution assumptions (validated to your comfort level)

- A set of explicit market assumptions (validated to your comfort level)

- A set of assumptions about the success of your product solution (validated to your comfort level)

- Cost of developing the product

- Cost of launching the product

- Sensitivity analysis of the revenue and profit models

- A discount factor is developed (probability of success on all fronts)(project ßeta)

- A pricing model

- A business model to deliver long-term success

- NPV

- IRR

- Payback period

- Strategic value (risk reduction, critical growth objective, etc.)

Side note 5: If, you are going to use this as one of the opportunity assessments in your portfolio planning process, then the there needs to be a pre-set standard quality level for validation of assumptions.

Can you win? This question is primarily an assessment of your internal capabilities and resources. Some of these questions feedback to the “worth it” question. For example, if you need to acquire or invent a new technology to provide an effective solution then you need to make sure the cost of invention or acquisition are in the financial models and it could well impact your discount factor (project ßeta).

Do you have, a cross all functions:

- The right people?

- Enough capital?

- Enough cash?

- The right sales force?

- The right knowledge?

- The right management control system?

- The right distribution model?

- Access to the right KOL’s?

- The right vendor base?

- Enough mfg. capacity?

- The proper internal systems? Etc.

For any sub-point no, you may plan to acquire the missing aspect that lead to a no; just make sure you discount the probability of success and account for it’s cost.

When you bring it all together the high level scoring is simple, if you don’t have yes, yes, yes, than move on. If you have some narrowly classified no’s, you may want to move to a higher level of accuracy (refer to note 3 above). Just remember that the goal is to eliminate the losers and select the winners. Make a decision and move on.

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com.

© 2016, The Experia Group, LLC