Set up

Several clients either have or are about to pivot their post-commercial product offering in a new direction. Strategic pivots are rare with post-commercial start-ups.

Typically, the pivot is driven by market forces. These market forces can create a real sense of urgency, almost a state of panic, to execute the pivot. Hopefully, the pivot is not a reboot or restart of the business. If that is the case, it is an entirely different situation than I am writing about today.

Historically, clients experiencing low revenue growth are missing one or two key elements that are readily fixable. If a pivot is required, then a more thorough assessment will be required to identify all the elements that need to be pivoted.

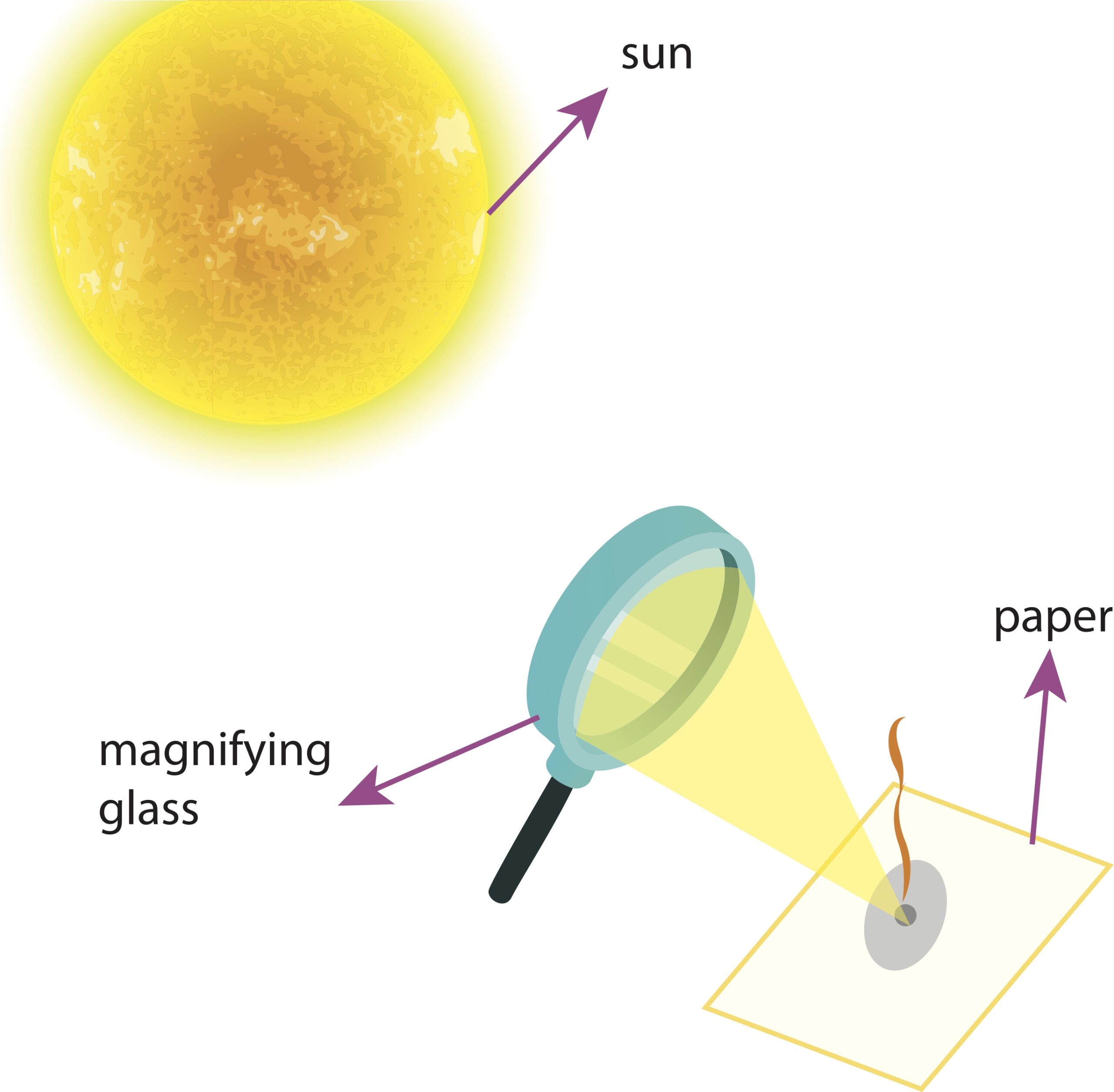

Before you commit to a pivot, you must audit every assumption or finding you have made from the original market scan. The grass may look greener on the other side of the fence, but until you dig in the dirt, you won’t know the quality of the soil. Here is a 10-point checklist you should consider during your pre-pivot planning process.

Checklist:

- Is the current Product* optimized for the new target?

- Is the current reimbursement still valid?

- Will new regulatory efforts be required?

- Will additional clinical data be required?

- Is the new target’s persona significantly different from the old target?

- Will the product messaging need to change in support of the a new persona?

- Will the new target require a new pricing strategy or price change +/-?

- Is your account targeting method still valid?

- Are there different competitors in the new target?

- Is your sales organization capable of accessing and supporting the new target?

This list is generalized; I encourage you to brainstorm your own list.

Failure to embrace the complete reality of the pivot can leave your company in a weaker long-term position. Incomplete pivots will always cause disruption in realizing the true potential that the new pivot holds.

Lesson (s)

- When considering a pivot, conduct a holistic audit of the changes that will be required.

- Do proper (structured) VOC work to understand the nature of the new customer, new stakeholders, competition, methods, purchasing behaviors, price tolerance, etc.

- Just because it intuitively makes sense that the environment will be similar, do the work to make sure.

*Product, spelled with a capital “P,” represents the entire product or service, including, but not limited to, Indications, instructions for use, packaging, training, disposal of, and shipping methods.

“Experience is what you get right after you need it most.”

Make it a great day!

Tim Walker, MBA

Tim is the Principal Strategist for The Experia® Group, LLC, which provides expertise and experience to medical device companies. An author, INSIGHT:33 lessons learned in medical device marketing, available on Amazon.

One-on-one and team coaching are also available.

www.theexperiagroup.com

© 2024, The Experia® Group, LLC