The Set Up

It has been some time since I actually performed a Legacy Product Line Rationalization. Two calls this week have prompted me to create this post. This is how I think about it.

As a Product Manager, one of the most necessary and potentially difficult tasks is to rationalize your portfolio product lines for an exit, maintain or invest strategy. If you review your product line performance on an annual basis, see AARP post, you will find that you have most of the data and insights you need.

The Goal of the Review

The goal is to rationalize your current portfolio based on the previous performance changes year over year. You pretty much have 3 options although they can be thought of as on a scale.

- Maintain

- Invest

- Divest

This review will point you toward actions that are needed in support of each product line. Your annual action plan can be driven by your findings.

“The Key is to be intentional about your product line.”

How do you do the review?

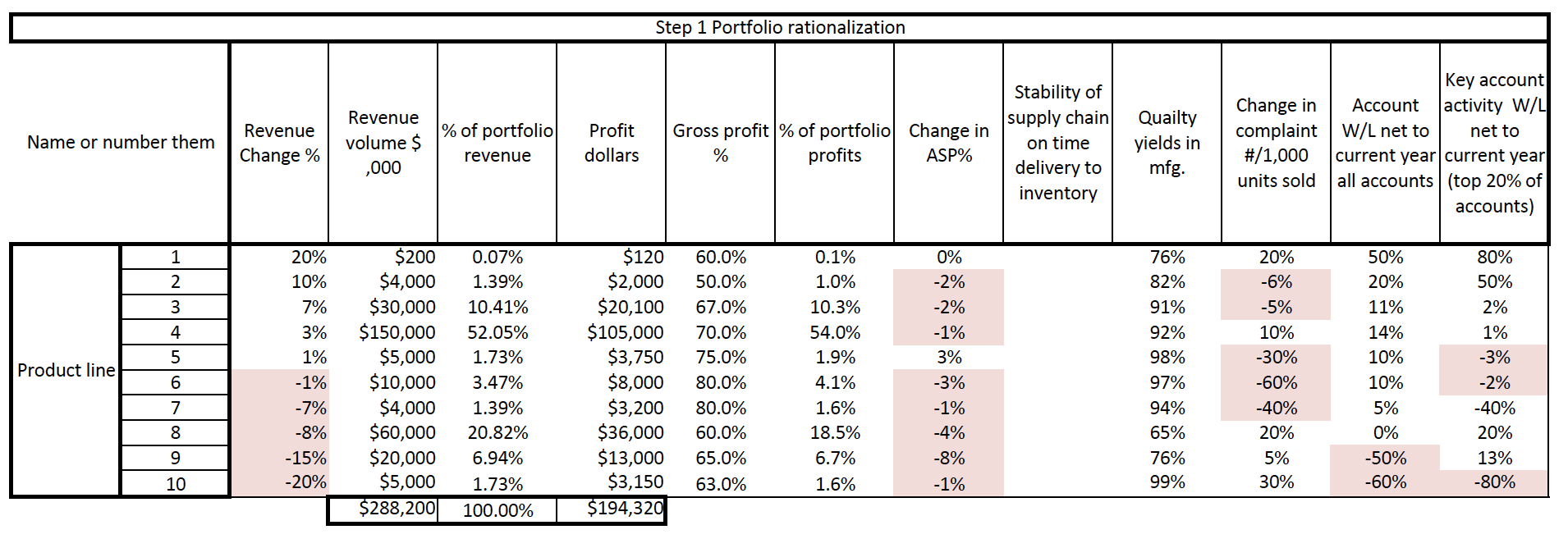

Step 1 – Collect and Organize Your Data

Determine a method for objectively determining how well your product lines are performing. Elements that you should consider including in your assessment or scoring tools are:

- The volume of revenue, ranking

- Change in revenue

- Gross profit dollars

- Profitability

- How ubiquitous the product is geographically

- How stable is the supply chain

- Quality yields

- Number of customers won and lost this past year

- What is the status of the treatment it is used on

- Of those customers who are buying, where do they stack up on your best customer rankings list

- Does it fit in the future strategic plan or will it become an orphan

The examples used here are designed to demonstrate a complex and murky review. Sometimes the answers pop off the page once you have organized all of the relevant data for your portfolio.

There are two aspects to this step. First, collect the data and rank each product line by element. Secondly, rank them all as a portfolio. The first step is fairly mechanical. The second is where the lines are compared by rankings.

So if you have 10 product lines your spreadsheet would look like the one shown below.

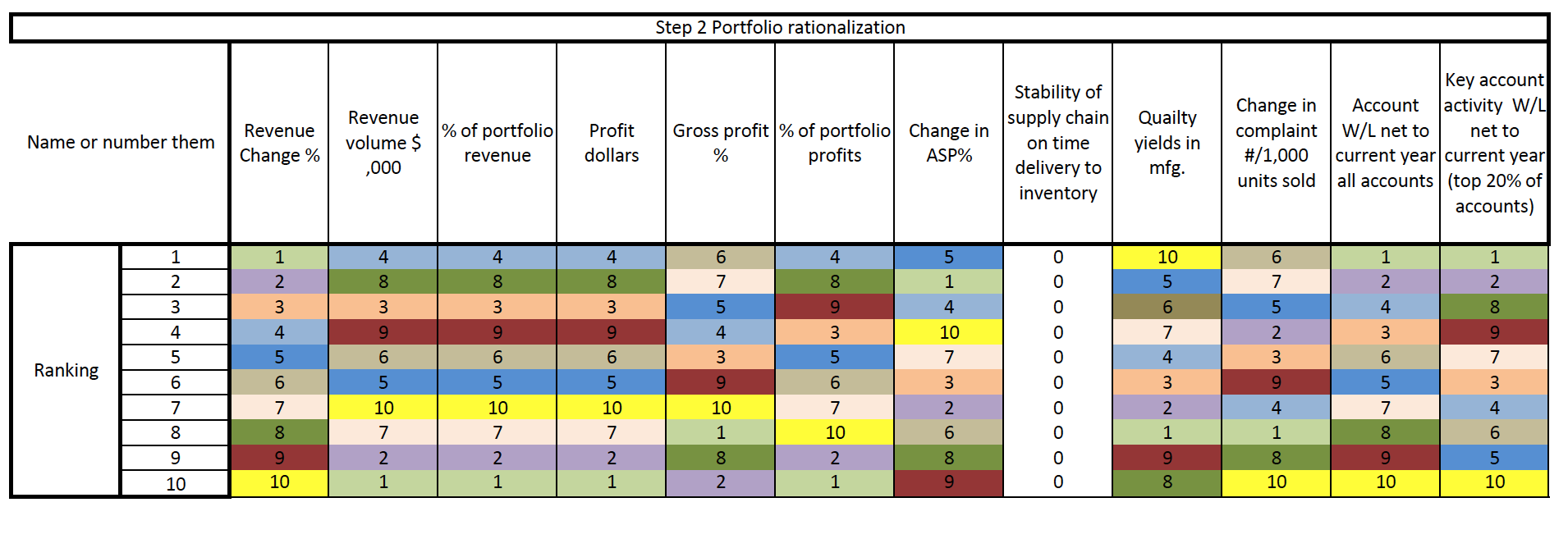

Step 3- Analyze the Rankings for Obvious Ins and Outs

Step 3- Analyze the Rankings for Obvious Ins and Outs

- Product line 1 is new, so it is IN

- Product line 2 this needs a deeper dive, a better understanding of the market conditions are required.

- Product line 3 solid performer so IN

- Product line 4 solid performer so IN

- Product line 5 solid performer with few key accounts so IN

- Product line 6 solid performer so IN

- Product line 7 this one needs a deeper dive. It is an average performer and seems like it will stay there for a while. If it still fits with your future vision for the portfolio it appears to be IN

- Product line 8 too big to cut, needs some mfg. improvements

- Product line 9 too big to cut, but needs a deeper dive so IN

- Product line 10 this needs a deeper dive but may be too big to cut without a plan

So there are six product lines that should not be cut, 4 that need a bit deeper dive. Another element that we did not take into account was synergy between product lines. Sometimes you keep an underperforming product line to support a high performing one.

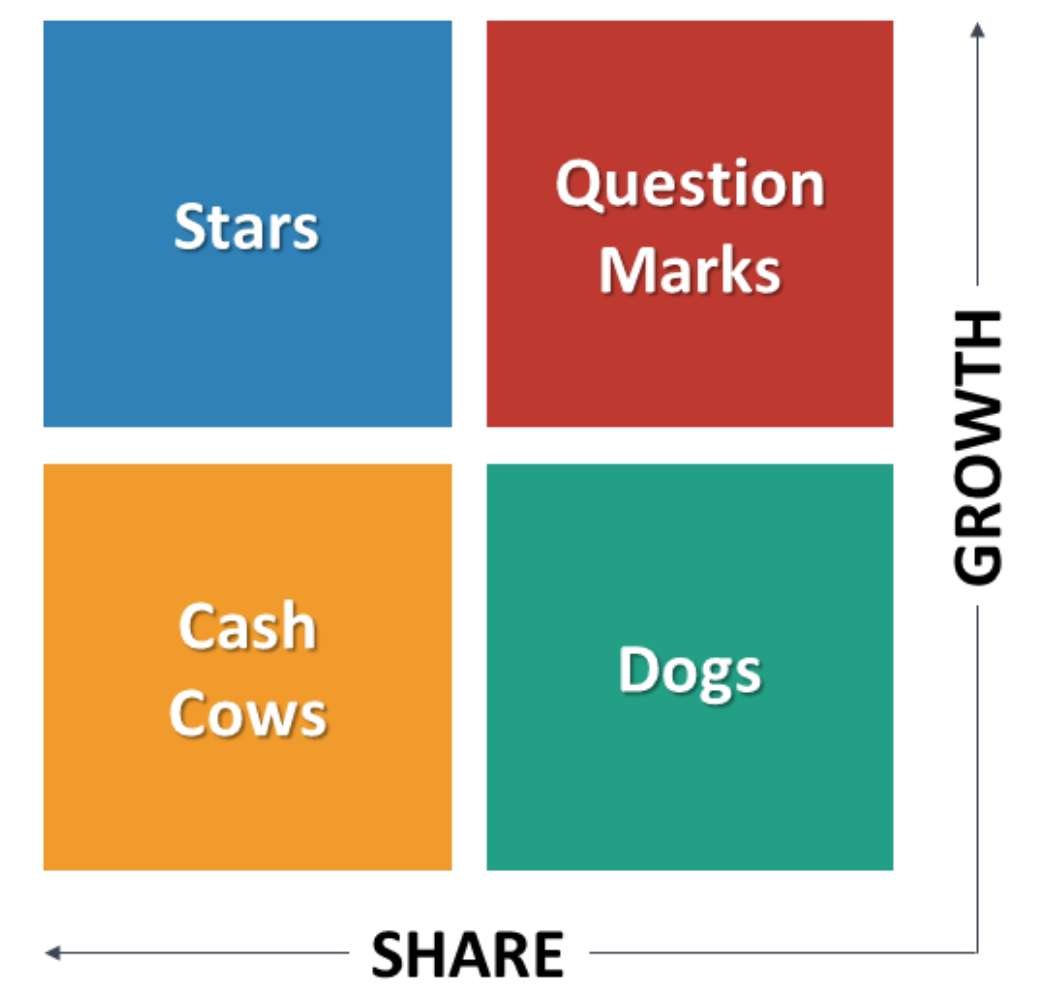

So if we plot our choices on to a Boston Consulting Group grid it can really give you a clear picture of your strategic position for each product line.

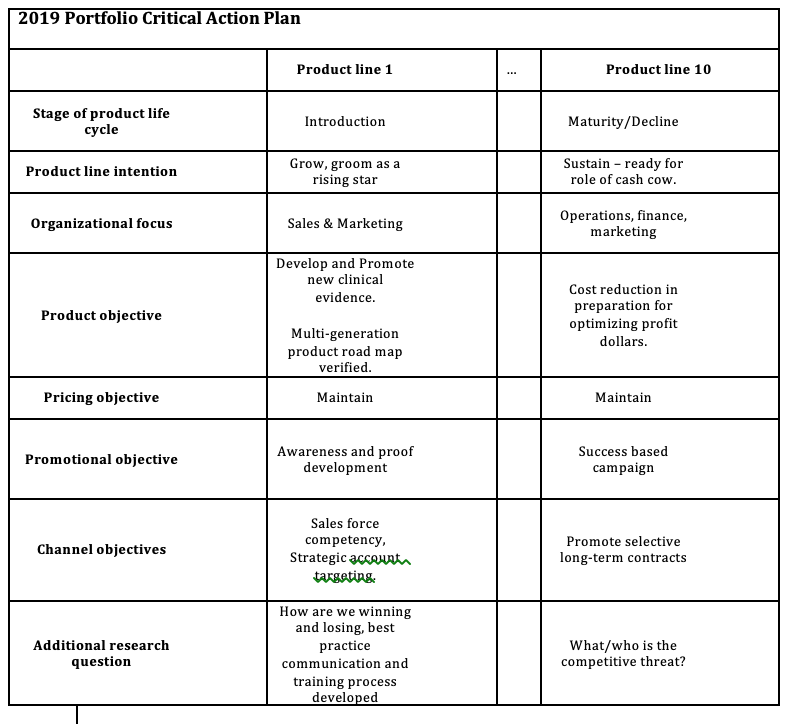

Combining this review with a go-forward plan you can use a matrix like this:

Follow this simple three-step process to rationalize your product line and defend your position. Keep the grid/worksheet with you in every meeting and you will be able to see at a glance where you are going next.

Follow this simple three-step process to rationalize your product line and defend your position. Keep the grid/worksheet with you in every meeting and you will be able to see at a glance where you are going next.

It is ok to keep all of the product lines. It is unacceptable to not know why you want to keep them.

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com. Contact The Experia Group for a free 30-minute consultation to determine if 30-years of experience can contribute to your success.

© 2019, The Experia Group, LLC