The Story

A prospective client approached me recently who needed help in setting the price for the new medical device they were about to commercialize. We sat down to go over the project and they indeed needed help. The first thing he told me was that they needed a 65% margin and the fully burden manufacturing cost of the device was expected to be $50.00, the plan was to price the device at $150.00.

I said great! You have met your goals. He stared at me for a while and then said, “but I think it is worth a lot more than $150.00.” As he got up and started to leave I said, “Why do you think it is worth more than $150.00?” He responded, “if they use my device instead of how they do it today, they can save time, reduce nursing injuries, and reduce their stocking inventories”.

The prospective client had put the cart before the horse, and instinctively knew it.

Understanding the value proposition of the device (the devices utility), in the eyes of the clinician users and economic buyers, is the first step. Pricing is the monetizing of that value, the second step.

Pricing Strategy

I am a big fan of writing out your pricing strategy very early in the commercialization process. Start with your financial goals, your unit / time goals, your situational analysis and the value proposition. Craft a sentence that best describes your intentions with respect to pricing an elevator speech for the sales force.

We will set our price, to ensure that we signal a congruent message with our value proposition, garner at least 50% of the added value of our widget, we will be profitable and we will be 80% confident that the price will not become a barrier to success in more than 20% of the A accounts.

Pricing

The art of monetizing value, pricing, is just that an art. I have spent as much as $140,000 doing value + pricing studies. I’ve spent as little as nothing. You need to do a situational review before you set off on value or price determination. By understanding the situation you can “right size” your effort (risk stratify the work). This is especially important for start-ups who need efficiency over effectiveness.

With setting price, it is never one size fits all. Here is a partial list of the questions that will lead you to understanding your pricing situation better:

What is the nature of the product that you are launching?

- Commodity

- Line extension

- Line expansion

- New product area within your current portfolio

- New portfolio

- Disruptive technology

What is the nature of the market into which you are launching the product?

- Current geography or new geography

- New segment or current segment

- New customer base or current base

- New channel or current channel

- Will there be value added services or not

Determine the risk if you under or over value the product?

- How forgiving have your customers been historically

- Do they give you second bites at the apple

- What are the consequences if you price incorrectly out of the gate?

- Do you slow the momentum down

- Do you cast doubt in the minds of the customers about the value of the product

- What will the competitive response be to a pricing error?

Watch out!

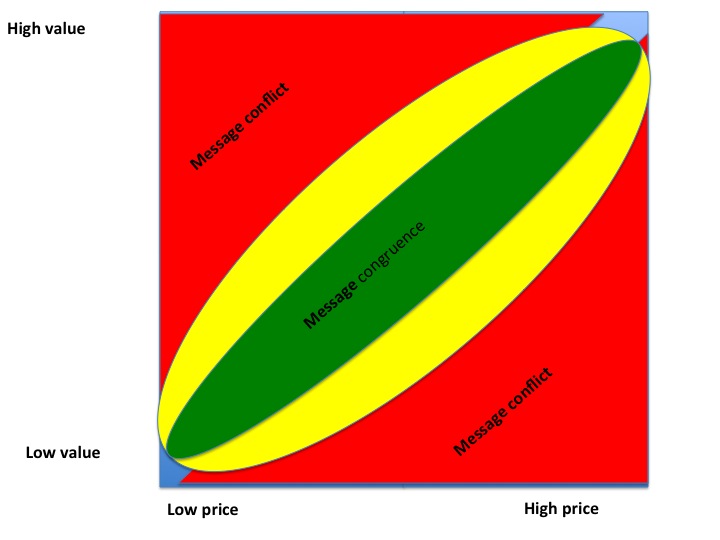

It is critical that your value proposition and your price point support each other. If you are talking about the device as, the greatest advancement of the therapy and you price it at the same price point of old technology, it sets up a disconnect in the hearts of the target customer. You have to resolve that disconnect before they will emotionally accept the value story.

So how do I set a price?

I am not trying to be disingenuous, but it depends. As a general rule of thumb, I try to split the increased value with the customer. For example, if my perspective client demonstrated an increase in hard value of 30% over the current state of the art product, I would increase my price, volume for volume, by 30% over the competition, hoping to realize 15%.

Caveats

In the medical device space there are always nuances that need to be taken into account. Reimbursement and service line profitability are always two potential barriers to realizing the true value of a new product. If the hospital service can absorb the premium and there are savings within that service then you may get the full value of the device. However, when you are selling into a service line that is barely profitable and you are changing their reimbursement/cost relationship, you may not get all you had hoped for.

A Happy Ending

We did the work to determine the added utility that the product in question brought to the critical care nurses and it came out to a 100% increase over the current technique. Total cost for the current technique was monetized at $308.00. Some of that 100% was based on a reduction of inventory cost, some was on saving time and some was on increased safety for the nurses (a reduction in lost time accidents). So our hypothesized price point was $600, not the $150 that the client has targeted.

We tested the monetization with a few nurse managers and no matter how much evidence we showed them, they just could not get their minds and hearts to accept the $600 value. Strategically, if we had priced the device at the point that we could justify, we would have either slowed acceptance, lowered demand, or failed all together.

Because the risk of being wrong had both a high probability (based on the initial qualitative interviews) and a high severity (given the financial state of the company) additional testing was warranted. We surveyed 30 key customers in the US. We selected the Van Westendorp PSM technique as our methodology. We discovered that 65% of our 30 surveyed customers would consider the product a good value between $300 – $400 dollars. An additional 23% indicated that they would consider $400 – $500 too expensive for general use, but would still purchase the device. Historically, I would have set the price point in the $450.00 range. There is typically a low bias when using survey methods to determine price points. However, in this case we set the Average Selling Price at $375.00 and held firm to that target. List price was set at $400.00.

We exceeded the target profit margin, we garnered a premium over current technology, and we did not inhibit the sales process. A win-win-win result!\

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com.