The Story:

I just completed teaching a Marketing Management course at the MBA level. In the same time frame I was working with a start-up medical device company advising on their investor deck. I reached a common realization. There is a natural tendency to inflate market projections by capturing every conceivable dollar potential worldwide. There is nothing unethical or morally wrong in putting your absolute best foot forward, but there is no value in inflating the opportunity.

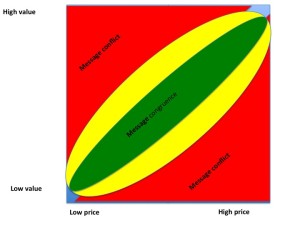

My professional opinion is that the revenue or potential opportunity you quote must be congruent (Walker’s Law of Congruency illustration below) with your overall story and plan. Angels, VCs and VPs of Marketing are too savvy to be drawn into an overstated market potential.

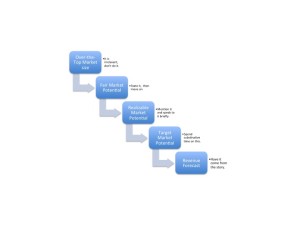

It is better to progress the story through the fair market potential to the realizable potential, quickly and then tell your story (plan) and state the five-year revenue forecast, then dwelling on a fantasy.

If your story doesn’t sound like it is worth it, or, if it doesn’t deliver on the expectations of Senior Management don’t fudge the model, change the story.

Over the Top Market Assessment

Over the Top Market Assessment

By over-the-top I am referring to the fact that every marketing plan I see states that the product represents a billion dollar opportunity. Not every marketing plan does have a chance at reaching a billion dollars and that is ok. If is does, it might be well beyond the timeline for a needed return.

Realizable Market Opportunity

In general, there are exclusions from the Grand market that are driven by the nature of your product. If the product has a narrow indication or is a line extension it probably will not be worth a billion dollars ever. It may be the first of five applications needed to reach full potential. It is not productive to spend a disproportional amount of time explaining the grand potential, mention it and move on to your story. As much as you would like to think that the most important thing to the reader is the huge market opportunity, it is not.

Most humans are risk adverse. They would rather see a tight story as to how you will realize the revenue forecast than create a dreamscape for the future.

Targeted Market Opportunity

I read with delight as a student defined the nature of the customer segment that they believed they would be successful with or in. By having a customer target, which you should have, you exclude a section of the Realizable Market Potential. If your segment represents only a quarter of the realizable potential then reduce that number by 25%.

Revenue Forecast

Once you know the Target Market Potential you continue to discount your potential for factors such as:

- Competition

- Capacity

- Market attractiveness (Did the product end up with the features and benefits you had hoped for?)

- Channel leverage

- The number of outlets

- The number of direct sales representatives

- Access to the targeted customers

- Launch timing

- Environmental barriers

Last but not least you need to have a beta factor (ß) a final reduction in your target market that represents the unknown and the unknowable. How do you calculate this last discount factor? You look to history either internal or external to your company. How accurate have your prediction been in the past. Do you have positive or negative reasons to believe that you will be as accurate this time?

Typically, the revenue forecasts are seldom realized. Of the 100+ products I have launched more of them under perform, in the first year, than over perform. After 30 years of product forecasting you would think that I could get the first year launch numbers correct. But there is always the unknowable and the X factor. The X factor is the political (not always bad) aspects of revenue forecasts. Typically, there is what you believe and then what everyone else is willing to bet on. Plot your actual performance against both numbers and learn.

Remember that your marketing plan will move through the project with you. At each step you need to add credibility by validating any and all assumption you have baked into the story. (E.g. the first version assumed that R&D would delivery on the utility that you wanted to commercialize. Some subsequent revision will account for whether they did or did not).

Note: The challenge to increasing accuracy with time is keeping the caveats and assumptions clearly in the mind of top management as decisions are made. I have been in many discussions just before launch where a Sr. Manager reminded me that my original forecast numbers where much larger than they are now at launch. You need to be prepared to answer that challenge without throwing the manager or the team under the bus.

“Experience is what you get, right after you need it most.”

Make it a great day,

Tim Walker

Tim Walker is the Principal consultant for The Experia Group. A small consulting firm that specializes in providing experience and expertise during critical device commercialization phases to increase the probability of success. www.theexperiagroup.com.

© 2016, The Experia Group, LLC